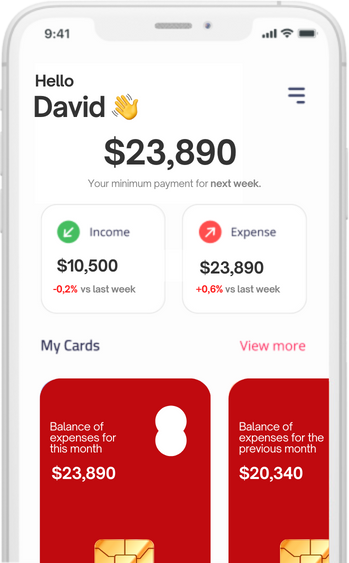

Unsecured loans and minimum payments make escaping debt feel impossible.

But there’s hope. We help people every day to break free from debt and start fresh.

We empower individuals affected by debt, inspiring meaningful action and lasting change. By negotiating with our trusted partners, debt burdens are reduced, and a customized financial plan is crafted to ensure repayment. Every step is guided until the debt is no longer a concern.

We proudly assist individuals across the U.S. by first gathering your personal financial information to understand your unique needs. From there, we match qualifying individuals with a debt relief program serviced by one of our licensed third-party partners. Through this customized evaluation process, we aim to help you reduce what you owe, avoid the stress of bankruptcy, and finally conquer overwhelming debt.

Your goal should be to pay off debt fast and at the lowest possible cost. If you only pay the minimums, you could end up paying double or triple what you owe—and it could take decades to finish. That’s not a plan! By restructuring your debt with affordable terms, you can save money, pay less, and become debt-free faster. Completing our program could save you thousands and put you on the fast track to financial freedom.

It’s not about what we say—it’s about what we deliver.

Our clients’ success stories speak for themselves. Hear what they have to share!

4+ Star Rating on Google

Monitor Debt Resolution

26500 Agoura Road, Suite 511

Calabasas, CA 91302

Phone: 888-863-3917

Email: info@monitordebtresolution.com

© Copyright 2025 Monitor Debt Resolution By Slvex | All Rights Reserved

*Disclaimer: Monitor Debt Resolution does not directly provide debt relief services. Our role is solely to connect you with licensed third-party debt relief providers who offer these services. Programs vary by state and may not be available in all areas, with fees differing based on location.

Debt relief programs generally last between 12 and 48 months, depending on the consumer’s debt load and individual circumstances. While specific results cannot be guaranteed, we strive to connect clients with providers best suited to help them achieve optimal outcomes.

Please note that Monitor Debt Resolution does not assume or pay clients’ debts, make payments to creditors, or provide tax, bankruptcy, accounting, legal advice, or credit repair services. We encourage you to consult with a tax professional for advice on the tax implications of debt relief and with a bankruptcy attorney for guidance on bankruptcy options.

Using debt relief services may negatively impact your credit and could result in collections or lawsuits from creditors. Additionally, your outstanding balances may increase due to the accrual of fees and interest during the program. Before enrolling, it’s crucial to carefully review and understand all program terms, conditions, and materials. Be aware that certain debts may not be eligible for enrollment, and some creditors may refuse to negotiate with debt relief companies.